Sustainable Banking

TISCO Group is committed to achieving a balance between economic, social, and environmental aspects of its business operations, following the Sustainable Banking Approach to meet the needs of all stakeholders while emphasizes quality growth with strong corporate value and culture. TISCO Group aims to use its expertise in all areas to enhance its performance and create good experience and financial opportunities for its customers and shareholders, which will ultimately deliver value to society and the broader environment.

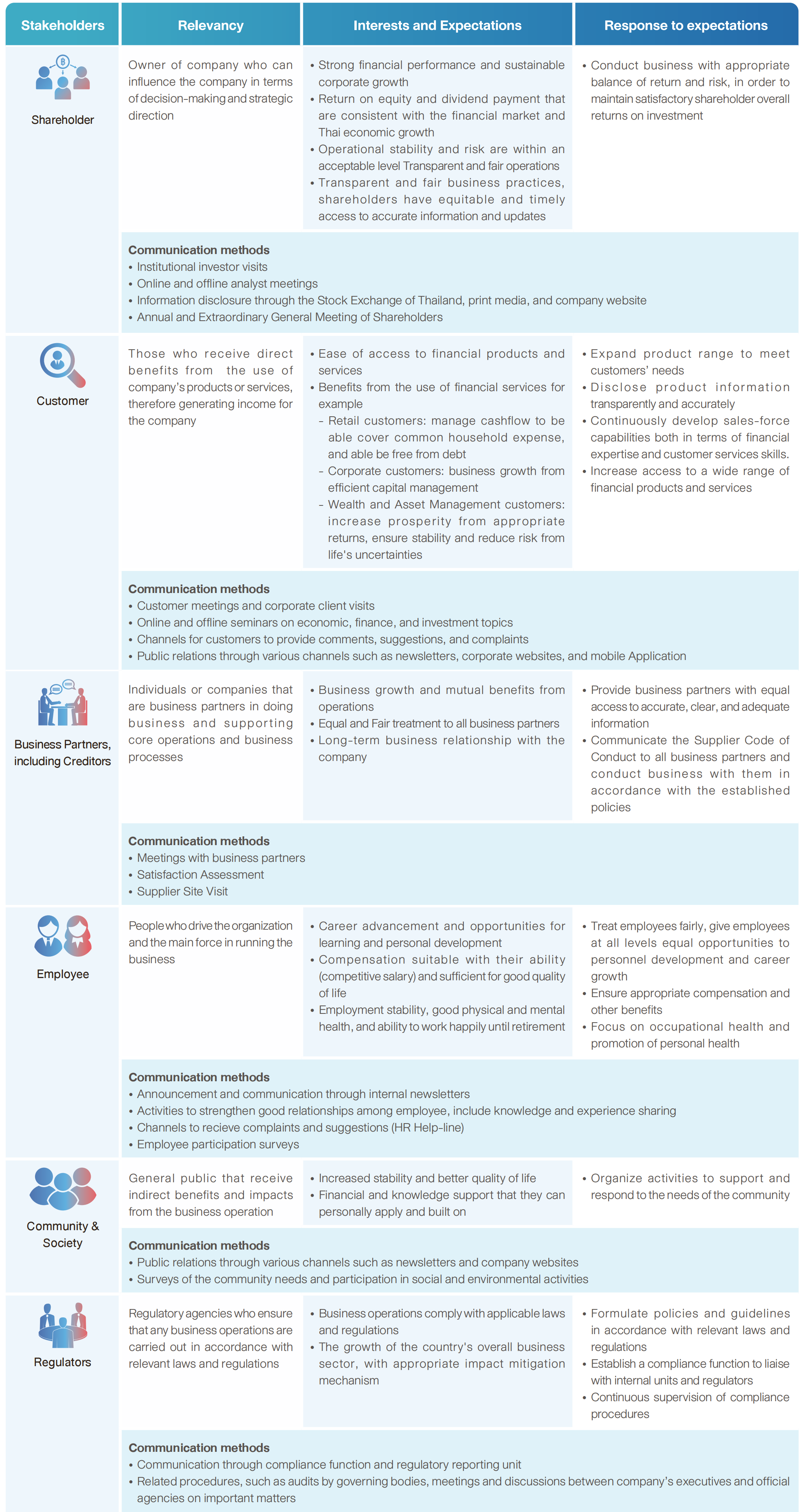

Stakeholder Engagement

TISCO Group values all stakeholders and has established a stakeholder management process, which involves identification and prioritization processes to truly understanding stakeholder expectations and interests, which enable TISCO to develop better financial products and services, as well as business practices for sustainable growth, and to deliver value according to the expectations of all stakeholders.

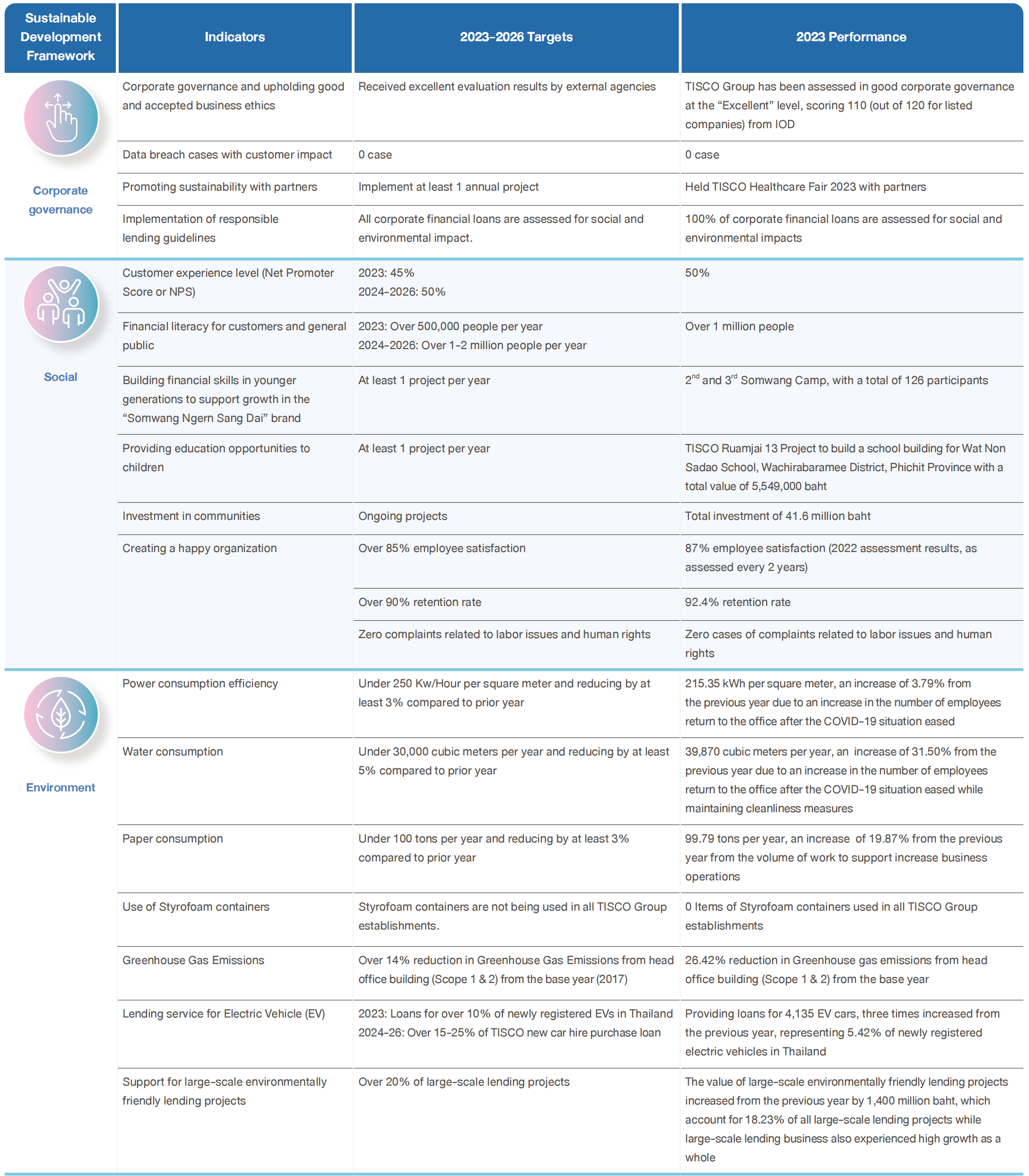

Sustainability Integrated Corporate Strategy

TISCO Group strives for sustainable and consistent business growth in the face of economic, social, and environmental challenges. Therefore, TISCO Group has integrated sustainability development into its core corporate strategy as a guiding principle and a goal for its operations, with environmental, social, and governance as the key considerations of this approach.

© Copyright 2018 TISCO Bank Public Company Limited. All rights reserved.