Good Corporate Governance at the Heart of Business

TISCO prioritizes offering customers innovative, creative, and appropriate financial services to meet the needs of customers while adhering to the highest ethical and corporate governance standards. TISCO also recognizes that businesses must operate in conjunction with being a good citizen of society and taking care of all stakeholders.

Strength and Sustainability over 5 decades

Corporate Governance is the force that drives TISCO in financial and investment business. The Company’s commitment to the highest ethical standards and good corporate governance is the result of its belief that a truly successful business is one that conducts itself as a good corporate citizen of the society in which it operates. This can only be achieved by ensuring that the rights and interests of all stakeholders: shareholders, customers, employees, business partners, competitors, society and the environment, are fully protected.

Good Corporate Governance at the Heart of Business

Corporate Governance Code of Conduct is set up to provide guiding principles of good corporate governance in order to ensure that the company complies with all relevant laws and regulations and carries out duties with maximum accountability, transparency, and equitable treatment to all stakeholders.

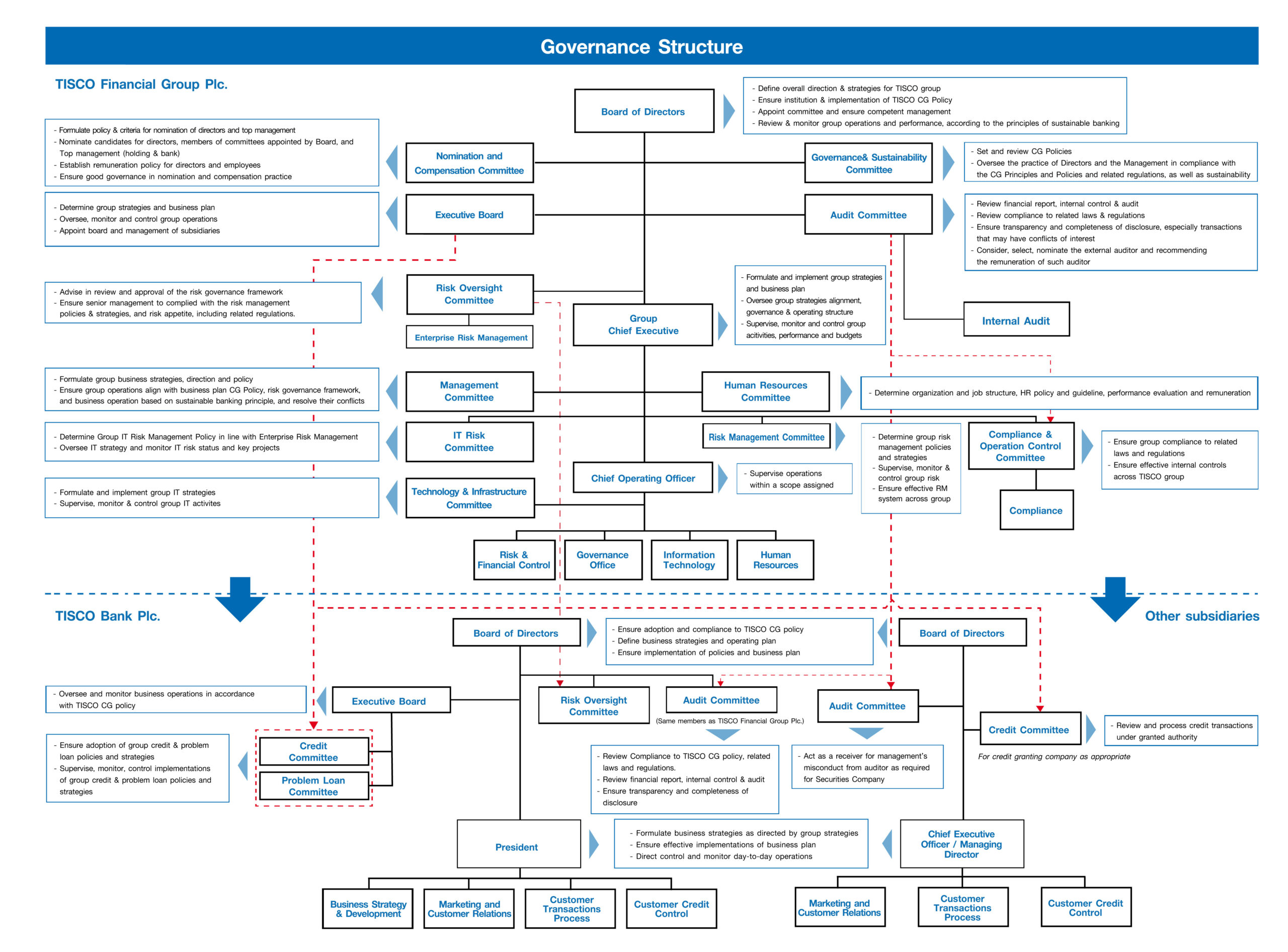

TISCO established the Corporate Governance Policy based on the principles of good corporate governance for listed companies in 2006, as provided by the Stock Exchange of Thailand. This policy covers the governance structure, corporate governance practices, operating structure, duties of regulatory agencies, and centralized operating policies to ensure that the Company and its subsidiaries strictly comply with the Corporate Governance Policy.

Banking Industry Code of Conduct

TISCO operates our financial and investment businesses in an ethical manner based on the Banking Industry Code of Conduct. Our employees are encouraged to adhere to the highest standard of ethics.

The Board of Directors and Management have adopted the new Banking Industry Code of Conduct, revised in 2016, to govern our business practices in alignment with good corporate governance principles.

The Code encourages TISCO and its employees to conduct business with integrity, sustain the balance between turnover and the impact on shareholders and customers, and adhere to sustainable business practices by taking social and environmental consequences into account.

Policy on Assessing the Independence of Directors

The Board of Directors has adopted the Policy on Assessing the Independence of Directors with recognition on the importance of transparency in its determination of a Director’s independence. The independence criteria, with international standard in consideration, are determined annually and are according to the Corporate Governance Code for Listed Company 2017. This is to ensure that the directors are able to make independent analysis with transparency, prior to the benefits of shareholders and stakeholders.

Succession Planning

TISCO Group is aware of personnel readiness and prepared succession plan for all key positions to ensure stability and continuity of business operations. The Board of Directors assigns the Nomination and Compensation Committee to oversee the preparation and periodic review of Top Management’s succession plan, starting from determination of selection policy, criteria, format and process considering factors such as qualification, education, knowledge, proficiencies, skill, and experience related to the businesses of TISCO Group, as well as the evaluation of qualified successor for key job position in TISCO Group

Roles and Duties of the Corporate Secretary

The Board of Directors resolved to appoint Mr. Pairat Srivilairit, First Executive Vice President – Governance Office, as Corporate Secretary, effective from September 1, 2013, to be responsible for preparing and maintaining director profile, notice and minutes of the board meeting, annual report, notice and minutes of shareholders meeting, maintaining directors and management’s report on conflict of interest, and performing other duties as required by the Capital Market Supervisory Board.